http://e-info.org.tw/node/116671

今年第三次出包 秘魯國營油管破裂 污染亞馬遜叢林

文字大小

141 1 Share1

本報2016年6月28日綜合外電報導,姜唯編譯;蔡麗伶審校

秘魯國營石油公司(Petroperu)位於秘魯東北部洛雷托大區(Loreto)的輸油管破裂,是今年亞馬遜雨林內的第三起漏油事故。

該輸油管在今年2月就曾出現兩處破裂,當時漏出超過1000桶的原油。秘魯國營石油公司正在調查此次破裂發生原因,目前尚不清楚共漏出多少原油。

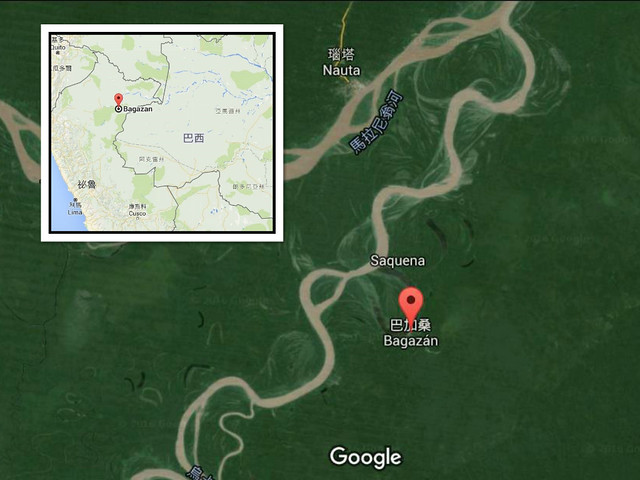

此次漏油地點位於秘魯與巴西邊界的亞馬遜叢林地區。圖片來源:Google地圖資料。

誰能忍受油污40年 原民綁架石油公司高層

因為這次的漏油事件,當地原住民Mayuriaga族綁架了秘魯國營石油公司和政府官員共六名人質,要求石油公司總裁維拉斯奎茲(German Velasquez)和管理高層訪視現場,商討清理對策。今年3月,Mayuriaga族就曾因居住地區因不明原因被排除在清理範圍之外,用軍用直昇機綁架了八名人質。

集體綁架,是秘魯原住民和偏遠社群要求與政府談判的常用手段。

聯合國原住民人權特別報告員安納亞(James Anaya)曾於2013年指出,石油開採工業對於亞馬遜雨林數十年來的負面衝擊,已對祕魯原住民造成「毀滅性的影響」。

「帕斯塔薩、提格雷、科連特斯和馬拉尼翁河流域原住民的處境,是祕魯種種自然資源危機之一,當地原住民已經受石油開發作業影響超過40年。」安納亞說。

油價低、頻漏油 祕魯石油業逼近癱瘓

此次漏油不但是秘魯國營石油公司的重大事故,也再次重創秘魯石油業。近年來,秘魯多家能源公司因油價低迷和社會衝突,任意放棄許可證或停止生產,導致產油下降,從2008年每天7萬7000桶減少至2015年每天5萬8000桶。

去年,阿根廷石油公司(Pluspetrol)在秘魯最大的192號探勘區的許可到期,該公司公開招標卻無人參與競標,只好倉促與潛在開採公司直接協商,以免產量完全歸零。

當阿根廷石油公司發給太平洋探勘(Pacific Exploration)公司兩年192號探勘區作業許可,洛雷托地方政府官員與工會領袖率領抗議,癱瘓首府伊基托斯(Iquitos),要求秘魯國營石油公司收回許可,自行在192號探勘區作業。

但是秘魯國營石油公司因為執行Talara精煉廠現代化工程而財務吃緊,依法不得另貸新款。秘魯國會為此特立新法,允許國營石油公司接管192號探勘區,但是該公司也已20年沒有鑽油了。

2月的漏油事件後,依賴北秘魯輸油管送油到500英里外Talara精煉廠的192號探勘區也因此停擺。

今天2月的漏油事件後,祕魯Wampis原住民族拍下污染狀況。圖片來源:Forest People Programme。

繼2015年全年產量比2008年少25%後,北秘魯輸油管的破裂立即又將亞馬遜地區產油量從每天2萬2000桶減少至9000桶。依賴石油營收的洛雷托州和烏卡亞利(Ucayali)州,預算兩個月內從240萬減少至160萬,降幅33%。

北秘魯輸油管這類的老舊設備和新探勘活動都需要大量投資,以避免再次發生環境危機。但是政府缺少資金,私人企業又不願在市場前景不佳的情況下冒險。

26日發布的一份商情報告指出,秘魯亞馬遜雨林在過去六年間共發生15次漏油事故。同一時期,產油量減少了20%。

|  |

| 祕魯Wampis原住民族拍下漏油污染的狀況。圖片來源:Forest People Programme | 一名當地婦女正在清理漏油。攝影:Barbara Fraser;圖片來源:Environmental Health News(CC BY-SA 4.0) |

Photo credit: Andina

The Petroperu-operated Northern Peruvian Pipeline has suffered the third spill this year in an Amazon jungle region in the northeastern state of Loreto.

Canal N first reported a possible spill on Friday when a local resident alerted police about oil contamination in the Barranca district of Loreto’s Datem del Marañon province. Petroperu confirmed the spill on Saturday and announced the company was executing its containment and cleanup protocol.

This is the Northern Peruvian Pipeline’s third spill this year. Over 1,000 barrels leaked when thepipeline suffered two ruptures last February. One breach was located in the Bagua province of Amazonas, with the other coming in Loreto’s Datem del Marañon, the same region as this week’s spill.

Petroperu said in a statement that the pipeline had not been pumping oil since being suspended four months ago. The company is investigating the cause of the accident. It is not yet clear how much oil was lost.

Natives from the Mayuriaga community kidnapped six officials from Petroperu and the government Cabinet. They demand that Petroperu president German Velasquez and other company executives visit the region to discuss the cleanup. The same community took eight hostages aboard a military helicopter in March when their area was unexplainably excluded from the state’s cleanup package.

Group kidnappings are a common negotiating tactic in Peru for indigenous and rural communities to demand action from the government.

The latest spill represents a major blow not only for state firm Petroperu but also Peru’s oil industry as a whole. Production is already down in recent years as skittish energy companies abandon licenses or shut down production amid lower commodity prices and increasingly frequent social conflicts.

Oil production in Peru fell from almost 77,000 barrels per day in 2008 to just 58,000 in 2015. That same year, Argentine firm Pluspetrol’s license to operate block 192, the country’s largest, expired. An auction held by industry-regulator Perupetrol received zero bids, forcing the government to negotiate directly with potential operators in a scramble to keep production from shutting downcompletely.

Loreto politicians and union leaders led strikes which paralyzed the provincial capital of Iquitoswhen Perupetro awarded Pacific Exploration a two-year license to operate block 192. Protesters demand that the nation’s largest oil license be operated by the state oil firm, Petroperu.

But the state oil firm is financially overextended with the Talara refinery modernization and legally barred from taking on new debt. An act of Congress freed the company up to take over block 192 operations, but the firm has not drilled oil in over 20 years.

The debate over which company would drill block 192’s oil was wiped from the agenda after the February oil spills, which demanded the closure of the Northern Peruvian Pipeline. Block 192 depends on the pipeline to deliver its crude production over 500 miles to the Talara refinery in Piura on Peru’s northern coast.

So after finishing 2015 producing 25% less oil than in 2008, the pipeline closure immediately cut production at fields in the Amazon jungle from 22,000 barrels per day to just 9,000. The state budgets of Loreto and Ucayali, which depend on royalties from oil revenue, fell 33% from $2.4 million to $1.6 million in two months.

“The drop in royalties is the most alarming consequence of the oil crisis, intensified now by the pipeline stoppage. As a result, the states have less money to build infrastructure, which means more unemployment and crime, strain the social relationship needed to develop projects,” Ronald Egusquiza, president of the Peruvian Society of Hydrocarbons (SPH), told El Comercio.

Aging infrastructure such as the Northern Peruvian Pipeline and new exploration demand significant investment to avoid further environmental damage. While the government does not have the financial resources to expand its role in Peru’s oil industry, private firms have proven unwilling to take the risk under current market conditions.

According to former mining and energy minister Eleodoro Mayorga, the oil reserves in the Amazon jungle are not large enough to warrant the construction of a new pipeline.

“The northern and central jungle regions likely have potential reserves in relatively small fields of 20 to 30 million barrels,” Mayorga writes in Harvard’s ReVista magazine. “The success of oil operations in this region depends on the continuity of service of the Northern Oil Pipeline.”

“All eyes in the oil industry are on the pipeline,” industry reporter Juan Saldarriaga wrote in El Comercio three weeks before the latest spill. “Because if there is another problem like this it will not only discredit Petroperu but also for the oil sector as a whole.”

“The problem is that the pipeline was built with technology from 50 years ago,” Carlos Galvez, president of Peru’s National Society of Mining, Oil and Energy (SNMPE), told El Comercio. “When it was built, they assumed it would be full all the time and that the oil would function as protection. But it has never been completely filled and is now empty in several sections, which accelerates corrosion.”

The pipeline was designed to transport 200,000 barrels per day, but in recent years has transported only 20,000 barrels per day.

A Petroperu official told El Comercio that the firm does not have the money to maintain the oil pipeline since all of its financial resources are dedicated to the modernization of the Talara refinery in Piura. In addition to the $3.5 billion Talara refinery modernization, the company is in the midst of a corporate restructuring which will allow it to attract private capital in the Lima stock exchange.

An El Comercio report on Sunday showed that Peru’s Amazon jungle has suffered 15 oil spills in the last six years. Over the same period, production has fallen by over 20%.

In November Perupetro announced that it would reduce royalties and the size of oil licenses in an effort to attract more energy firms to invest in Peru’s oil fields.

While oil prices enjoyed a slight recovery this year, briefly touching $50 per barrel, the United Kingdom’s vote to exit the European Union sent prices plummeting last week by almost 5% to $47 per barrel.

Sources

ESTADISTICA PETROLERA 2008 (Petroperu)ESTADISTICA PETROLERA 2010 (Petroperu)ESTADISTICA PETROLERA 2015 (Petroperu)COMUNICADO (Petroperu)Petroperú activa plan de emergencia (El Peruano)La Amazonía ha sufrido 15 derrames de crudo en 6 años (El Comercio)¿Ineficiencia o desidia?, por Antonio Zevallos Diez (El Comercio)Loreto: Nativos retienen a seis funcionarios de Petroperú y de la PCM tras derrame de petróleo (Correo)

沒有留言:

張貼留言