總網頁瀏覽量

【○隻字片羽○雪泥鴻爪○】

○○○○○○○○○○○○○○○○○○

既然有緣到此一訪,

何妨放鬆一下妳(你)的心緒,

歇一歇妳(你)的腳步,

讓我陪妳(你)喝一杯香醇的咖啡吧!

這裡是一個完全開放的交心空間,

躺在綠意漾然的草原上,望著晴空的藍天,

白雲和微風嬉鬧著,無拘無束的赤著腳,

可以輕輕鬆鬆的道出心中情。

天馬行空的釋放著胸懷,緊緊擁抱著彼此的情緒。

共同分享著彼此悲歡離合的酸甜苦辣。

互相激勵,互相撫慰,互相提攜,

一齊向前邁進。

也因為有妳(你)的來訪,我們認識了。

請讓我能擁有機會回拜於妳(你)空間的機會。

謝謝妳(你)!

●●●●●●●●●●●●●●●●●●

這裡是一個完全開放的交心空間,

躺在綠意漾然的草原上,望著晴空的藍天,

白雲和微風嬉鬧著,無拘無束的赤著腳,

可以輕輕鬆鬆的道出心中情。

天馬行空的釋放著胸懷,緊緊擁抱著彼此的情緒。

共同分享著彼此悲歡離合的酸甜苦辣。

互相激勵,互相撫慰,互相提攜,

一齊向前邁進。

也因為有妳(你)的來訪,我們認識了。

請讓我能擁有機會回拜於妳(你)空間的機會。

謝謝妳(你)!

●●●●●●●●●●●●●●●●●●

2015年9月30日 星期三

只有確實法辦馬英九,台灣的司法才算及格、台灣的社會才有正義!

520卸任之前、最晚2016大選投票日後就該進行的動作,所以現在就該盯緊了……[轉]…強烈支持2016新政府循司法手段限制馬英九出境,以免其潛逃,並展開其眾多弊案的調查。

當然啦,若這麼做一定會被藍營炒作是「挾怨報復」、「政治迫害」等方向,來降低法辦馬英九的合理性,博取同情。所以大家要事先凝聚社會共識,提早做準備,要讓社會氣氛達到就是要辦馬英九,法網恢恢,就是不能漏掉馬英九!

只有確實法辦馬英九,台灣的司法才算及格、台灣的社會才有正義!https://www.facebook.com/permalink.php?story_fbid=1630452157210865&id=100007382895181&fref=nf&pnref=story …

https://www.facebook.com/permalink.php?story_fbid=1630452157210865&id=100007382895181&fref=nf&pnref=story

10大倒債大亨 400億資產法拍變爛帳

我把三張名單整理出來國民黨又不用動腦了

三餐加消夜都是2100,逃亡中國都在吃香喝辣

有案底的歡迎回國民黨,因為你是我的兄弟,貪污最團結

加起來幾千億全國的國中小營養午餐大概可以免費供吃100年

黨產就是這樣累積出來的,恥力無上限

返貪腐不疑餘力啊!中國黨滾回中國

......................

10大倒債大亨 400億資產法拍變爛帳

2015-09-28〔記者徐義平/台北報導〕

根據法拍業者統計,歷經十信危機到亞洲金融風暴、全球金融海嘯等,法拍市場前十大倒債富豪留下的一千一百億餘元不良資產爛帳中,到現在仍有四百億餘元難解。其中「債留台灣、錢進中國」的東帝士集團總裁陳由豪留下的爛帳最多、金額最高;遭法拍資產達三八八筆、合計二三三億餘元,但十二年來僅處理掉八十六筆,換回約九十八億元現金,仍有高達三百餘筆、超過百億元爛帳難解。

陳由豪三百餘筆、逾百億元最多

根據寬頻房訊統計,依照法拍不良資產的債務金額排名,依序為東帝士集團陳由豪、台鳳黃宗宏、廣三集團曾正仁、華隆紡織翁大銘、鴻禧張秀政、太子汽車許勝發、中國力霸王又曾、三陽投資黃世惠、十信蔡辰男及三勝製帽戴勝通等;其中前七名留下的法拍爛帳均超過百億元。

從脫標情況來看,以翁大銘債務拍定金額最高,約卅七筆法拍債務、總底價約一四○.六六億元,目前已拍定廿七筆,換回約一二○.五二億元,標脫率逾六成;而蔡辰男名下遭法拍的汐止地區卅萬餘坪山坡地保育區土地,經過三拍後,終於在上週被英業達集團會長葉國一以底價五.三二億元買下,讓蔡辰男從法拍「萬年流當品」名單中順利除名。

處理狀況最差的前兩名是陳由豪與黃宗宏,若以標脫筆數占全數法拍筆數計算,都不到三成。法拍業者分析,因為當初抵押的土地與資產均是偏遠地區的保護區土地或是非精華土地,才會導致持續流標。

寬頻房訊法拍專員徐華辰指出,法拍前十大倒債富豪中,陳由豪、曾正仁及王又曾三人都是通緝中的經濟要犯,三人合計在台灣掏空金額恐超過一千五百億元,這些債留台灣大戶名下或旗下公司資產大多非位於精華區內,債權人若想要透過法拍程序來取回全部債權,恐是遙遙無期。

打臉藍軍的最強武器

打臉藍軍的最強武器

汐止都不淹水房價大漲,阿扁出來負責啦!

所以這新聞出現一次,就提醒我一次要看不起李鴻源跟汐止人

「扁德政」員山子分洪量破紀錄 vs. 李鴻源:分洪如可行 國民黨廿年前就做了 打臉最強武器

- SEP 30 2015

「扁德政」員山子分洪量破紀錄 vs. 李鴻源:分洪如可行 國民黨廿年前就做了 打臉最強武器

打臉藍軍的最強武器

汐止都不淹水房價大漲,阿扁出來負責啦!

所以這新聞出現一次,就提醒我一次要看不起李鴻源跟汐止人

水牛害人家KMT少掉兩千七百億可追加預算人民對不起國民黨

2015-09-29【水利署】杜鵑颱風員山子結束分洪

水牛害人家KMT少掉兩千七百億可追加預算人民對不起國民黨

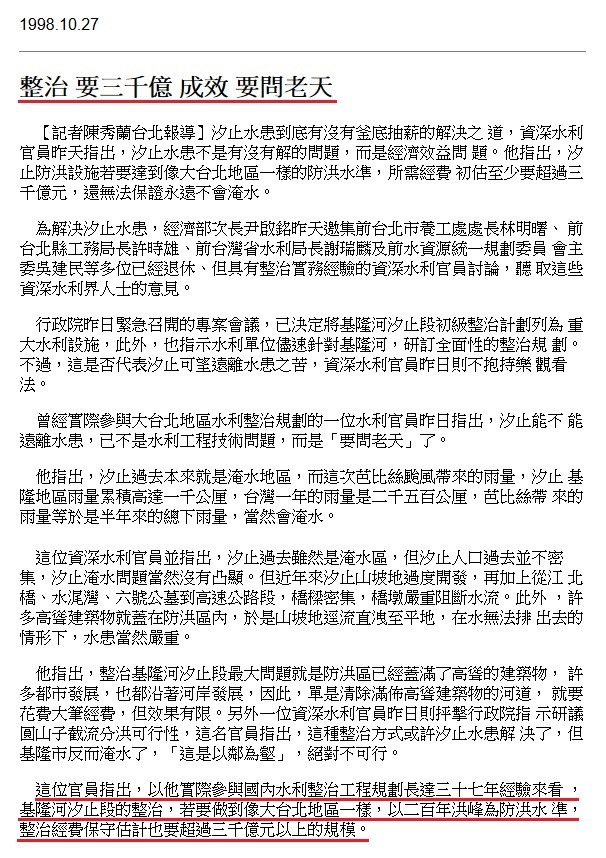

1998-10-27 整治 要三千億 成效 要問老天

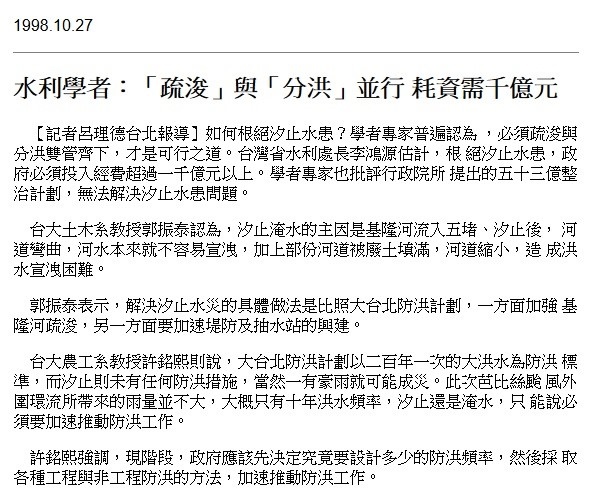

1998-10-27 水利學者:「疏浚」與「分洪」並行 耗資需千億元

水利專家當的真落漆,20年蓋不好,那你有花40年嗎?

游錫堃:他們説要花千億,我們只用300億; 而「水利專家」李鴻源反對興建。

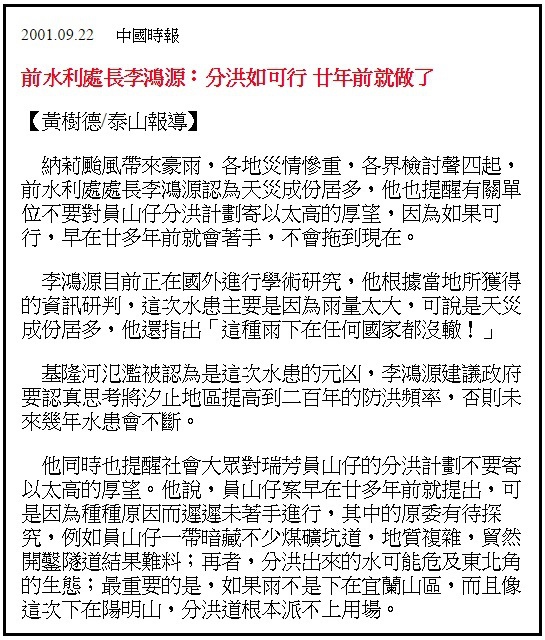

2001-09-22【中國時報】前水利處長李鴻源:分洪如可行 廿年前就做了

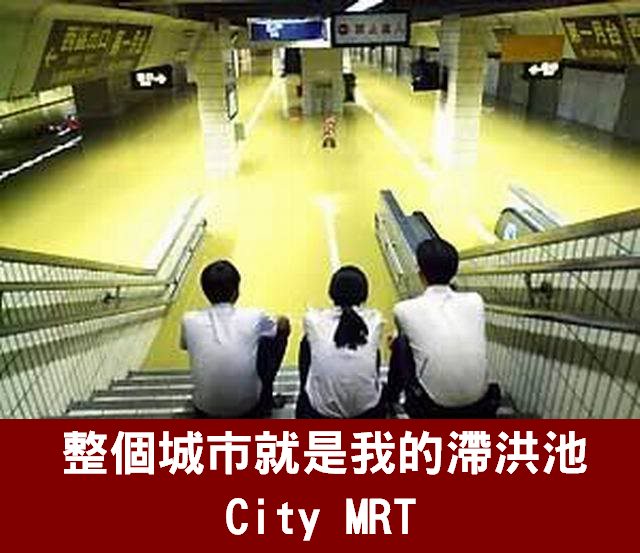

員山仔分洪33次,反觀捷運滯洪池1次

馬總統震怒:都是員山仔,害我的捷運滯洪池沒作用!!

2013-09-05【公視新聞】昔北捷淹水當滯洪? 馬挨批麻木不仁

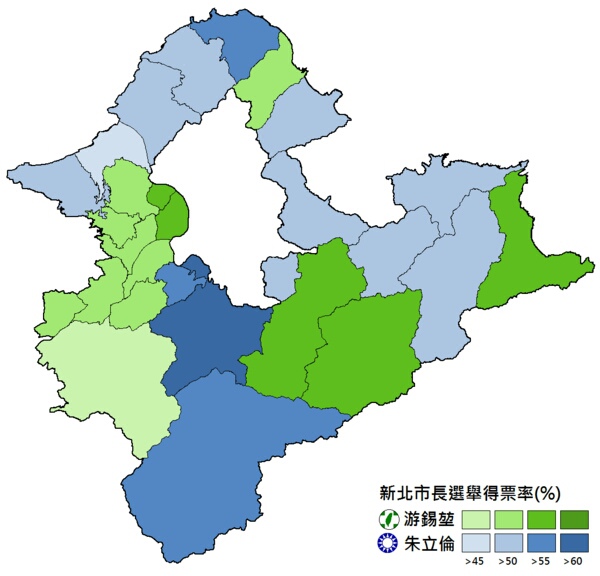

新北市豬隊友分布圖

阿扁跟水牛對新北人根本有救命之恩,結果新北還不是選2.

阿扁跟水牛對新北人根本有救命之恩,結果新北還不是選2.

人一藍,腦就殘阿!很奇怪嗎?

國民黨應該要吃很多的慚愧棒棒糖 一直說謊

國民黨應該要吃很多的慚愧棒棒糖 一直說謊

--------------------

服貿最公開透明,

2015-09-30 馬英九:服貿協議是最透明的議案

2014-03-24 服貿荒唐30秒 馬挺張慶忠:被迫的

◎國民黨最清廉,

世界史上最大貪腐集團---國民黨!

◎馬英九最重視民主與人權,

2014/12/10 總統:追求民主人權沒有終點

2014-03-24 鎮暴警強勢驅離 多人濺血送醫

◎吳敦義最誠實,

2010-09-01 吳敦義無薪假得諾貝爾獎

◎洪秀柱最有禮貌,

2011-12-28 洪秀柱砲轟蔡英文爆粗口:「恁祖媽」

◎蔡正元最尊重智慧財產權,

2015-09-09 指帽為「帳」掀筆戰!蔡正元盜圖被抓 反向製作人討廣告費

◎吳育昇對婚姻最忠誠,

2009-11-13 直擊 立委吳育昇 帶香奈兒美女上薇閣

◎張博雅行事最嚴明公正,

2015-01-07 銓敘部不甩監察院 郭冠英爽退生效

◎李朝卿最重視工程品質,

2015-04-29 工程涉貪瀆 李朝卿被求處30年

最可憐的是被號稱最無能的批評,這才最慘的

馬英九執政這八年最大的成就,是幫百姓裂解在台灣不公不義的國民黨!!

最可憐的是被號稱最無能的批評,這才最慘的

總統立委選情低迷 馬英九怒責:朱立倫黨主席幹假的嗎

賴清德首度公開宣示「我主張台灣獨立!」

有種!夠霸氣,9.2崩潰

還反酸國民黨殺豬拔毛

台灣本來就是一個國家!!!

有台灣意識才是正港台灣人,只會舔共的快滾

賴清德一連說了2次「我主張台灣獨立!」並沒有說要主張一定要兵戎相向,

中國也要尊重台灣人民主權獨立的主張,殺豬拔毛一直是國民黨的政策。」

賴清德首度公開宣示「我主張台灣獨立!」

Which is the most peaceful country in the world?

17 Comments

- 10K+Share on Facebook (Opens in new window)10K+

- 5K+Click to share on Twitter (Opens in new window)5K+

- 1K+Click to share on LinkedIn (Opens in new window)1K+

Despite an increase in geopolitical tensions and an upsurge in violence in certain parts of the world, last year saw the overall level of global peacefulness remain stable, according to the latest Global Peace Index report.

Four regions experienced an improvement in peace: Europe, North America, sub-Saharan Africa and Central America and the Caribbean. The remaining five regions – Asia Pacific, South America, Russia and Eurasia, South Asia, and the Middle East and North Africa – saw a deterioration.

The MENA region is ranked the least peaceful in the world and saw the most significant changes compared to the previous year as violence flared across Iraq, Syria, Libya and Yemen.

Overall, 81 countries became more peaceful while 78 countries were worse off.

The Global Peace Index, issued by the Institute for Economics and Peace, ranks 162 independent states covering 99.6% of the world’s population.

The 10 most peaceful countries

- Iceland

- Denmark

- Austria

- New Zealand

- Switzerland

- Finland

- Canada

- Japan

- Australia

- Czech Republic

The 10 least peaceful countries

- Syria

- Iraq

- Afghanistan

- South Sudan

- Central African Republic

- Somalia

- Sudan

- DR Congo

- Pakistan

- North Korea

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Paul Muggeridge is Head of Content at Formative Content.

Image: A pile of rocks stand in front of a waterfall in Skogarfoss, Iceland May 28, 2011. REUTERS/Lucas Jackson

Posted by Paul Muggeridge -

All opinions expressed are those of the author. The World Economic Forum Blog is an independent and neutral platform dedicated to generating debate around the key topics that shape global, regional and industry agendas.

9 economists whose ideas are changing the world

We’re living in the age of the rock star academic.

Everyone is trying to make sense of financial crises and the old economics textbooks don’t work so well anymore.

So it’s natural to turn to the people who study this stuff for a living.

Thomas Piketty, a French academic, sold 1.5 million copies of his book “Capital in the Twenty-First Century,” while Nobel prize-winning economists like Paul Krugman and Joseph Stiglitz can be found burning up social media, the newspapers, and the conference circuit.

But not everyone with influential ideas on economics and finance is as well-known.

Here are the academics that are changing the world behind-the-scenes. The list isn’t exhaustive. If you think we’ve missed anyone out then please email in suggestions.

1: Ha-Joon Chang, University of Cambridge

Alma Mater: Seoul National University

Big Idea: Developed countries talk a lot about the free market but really use their power and financial strength to profit at the expense of emerging economies.

Chang’s ideas are controversial, centering on the role that international bodies like the IMF and World Bank play in the world economy.

In books such as Kicking Away the Ladder and The Myth of Free Trade he argues that the governments of bigger economies help out their own companies, while preaching the benefits of the free market to developing nations.

2: Katherina Pistor, Columbia Law School

Alma Mater: University of Freiburg

Big Idea: The rule of law must be suspended for financial markets in a crisis, or the whole system will collapse.

Pistor, who won the Max Planck academic research award in 2012, is developing a legal theory of finance to work out how laws affect its shape and composition.

She discovered that, in a crisis, the regulations that build markets aren’t worth the paper they’re printed on. Political power is the driving force behind who gets hit in the heat of the moment.

3: Charles Calomiris, Columbia Business School

Alma Mater: Yale University

Big Idea: Financial collapses don’t happen at random and aren’t inevitable.

They come from complex bargains between politicians and bankers that spiral out of the government’s control. That’s one of the reasons why the US has had 12 major banking crises since 1840, while Canada has had none.

4: Jon Danielsson, London School of Economics

Alma Mater: Duke University

Big Idea: Trusting your risk models will lose you money in a crisis.

Risk models will generally tend to have the same outcomes when everything is going well, even if they have different mathematical foundations.

This tricks people in to thinking that they work all the time. But when all hell breaks loose, the models will give you wildly different risk assesments, leaving you flying blind.

This is bad for banks and hedge funds but even worse for central banks, who have to make policy decisions for everyone else.

5: Marianne Bertrand, University of Chicago Booth

Alma Mater: University of Brussels

Big Idea: CEOs are rewarded for luck rather than performance. Also, employers judge applicants on their name as much as their qualifications.

Bertrand is one the reasons why there’s been such a shareholder backlash against CEO pay, after proving their huge bonuses are based on luck rather than genius.

In a 2003 paper, she and Sendhil Mullainathan also famously replied to help-wanted ads in Chicago and Boston with fake names. Some applicants used names like Emily and Greg, while others used names like Lakisha and Jamal.

“The results show significant discrimination against African-American names,” the authors wrote. “White names receive 50% more callbacks for interviews.”

6: Alvin Roth, Harvard University and Stanford University

Alma Mater: Columbia University

Big Idea: You don’t need money to make a stable market for something.

Roth, along with Lloyd Shapely, won the Nobel Prize in 2012 for showing that people can make a market based on mutually-beneficial swaps rather than cash to satisfy a specific need.

This was particularly useful for easing the shortage of kidney donors in the US. Roth used game theory to pair up donors with patients they didn’t know, making it easier for people to swap their organs and find a match.

7: Richard Portes, London Business School

Alma Mater: Yale University

Big Idea: Bondholders can often work together to get concessions from a borrower.

Portes, now professor of economics at London Business School, laid down the groundwork for collective action clauses, where sovereign bondholders use their bargaining power to impose conditions on a debtor country. The work has been especially important in cases like Greece or Argentina.

8: Charles Goodhart, London School of Economics

Alma Mater: Cambridge University

Big Idea: Goodhart’s Law.

Goodhart said that as soon as governments or central banks turn a statistic, such as the stock market, into an implicit policy target, it ceases to become a reliable statistic.

This is because players in financial markets change their investment strategies to pre-empt the policy.

Goodhart was one of the orignal members of the Bank of England’s monetary policy committee in 1997, and a veteran of financial crises in 1970s.

9: Alberto Alesina, Harvard University

Alma Mater: Bocconi Univerisity, Milan

Big Idea: Far from hurting growth, austerity measures can actually help economies recover.

In 2009, Alesina and Silvia Ardegna published a paper called Large Changes in Fiscal Policy: Taxes Versus Spending.

It was an important part of the debate in the years that followed over whether austerity and reducing debt or boosting government spending were the best strategies for economies recovering, cited by fiscal hawks.

This article is published in collaboration with Business Insider. Publication does not imply endorsement of views by the World Economic Forum.

To keep up with Agenda subscribe to our weekly newsletter.

Author: Ben Moshinsky is a senior finance reporter, covering markets and banks. He previously worked for Bloomberg News in Brussels and London.

Image: French economist and academic Thomas Piketty, poses in his book-lined office at the French School for Advanced Studies in the Social Sciences (EHESS), in Paris. REUTERS/Charles Platiau

Posted by Ben Moshinsky -

All opinions expressed are those of the author. The World Economic Forum Blog is an independent and neutral platform dedicated to generating debate around the key topics that shape global, regional and industry agendas.

How can business improve global health?

The dramatic success of the Millennium Development Goals (MDGs) in driving advances in human health will be a hard act to follow. In just 15 years, child mortality was nearly halved, and malaria deaths declined by 60%. Today nearly 15 million people worldwide receive treatment for AIDS, helping them continue to be productive members of society, compared to only about 10,000 people in 2000, when the MDGs were launched.

Can the new Sustainable Development Goals (SDGs), just adopted by the United Nations to guide global development efforts for the next 15 years, replicate the MDGs’ success? The strong track record of the MDGs certainly provides grounds for hope. But the new health-related goals are broader and more ambitious than before. And the public-health situation is in many ways more challenging than in 2000.

The new SDGs set a lofty goal: for the first time, world leaders have vowed to reduce premature deaths caused by chronic illnesses such as cancer, heart disease, and diabetes. This is a tall order at a time of rapid population growth and rapid aging. Chronic diseases are the main – and growing – cause of death in both settings. And more than two billion people still lack access to essential medicines.

To achieve the new targets, we must find creative new ways to address the world’s biggest health challenges. Above all, we must develop new business models that allow society to better harness the know-how, creativity, and drive of private enterprises to help improve public health. Companies share the responsibility for meeting these new goals, but they also need support from governments and other organizations to ensure the greatest positive impact.

The demographic challenge is daunting. A billion people joined the human race in just the last 12 years. Another billion or so will join by 2030, bringing the world’s population to 8.5 billion, according to UN estimates. The fastest-growing segment of the population is people over 60, a group that is expected to grow by 500 million people, to 1.4 billion, in 2030.

Older people are more likely to develop chronic illnesses, which now account for 63% of all deaths worldwide. The World Health Organization predicts that the proportion will reach 70% in the next ten years, with most of the deaths occurring in developing countries. Some 28 million people die from chronic diseases in low- and middle-income countries each year, accounting for roughly three-quarters of all deaths caused by chronic disease globally.

Developing countries’ health systems are already stretched. They often lack medicines, resources, and know-how to treat chronically ill patients, who may require years or decades of treatment. For example, there are only four oncologists in Ethiopia, a country of some 97 million people. Moreover, many developing countries face a double disease burden and must wage a simultaneous battle against infectious diseases such as malaria, tuberculosis, and HIV/AIDS.

Clearly, more resources will be needed to tackle these challenges. But in the wake of the global financial crisis, development assistance for health from governments and private donors has plateaued at about $35 billion annually, after growing more than 11% per year from 2000-2010. And less than 2% of that money was directed at combatting chronic diseases.

The long-term nature of chronic diseases, and the complexity of providing better treatment for patients in the developing world, calls for innovative solutions. Companies possess the capabilities and the global scale to play a stronger future role in addressing public-health challenges and achieving the objectives of the SDGs.

Some corporations are beginning to explore new “social business” approaches that will allow them to meet the needs of people and society in the developing world, while at the same time covering their costs, or even making a small profit. Moneymaking social ventures are self-sustaining and have the potential to grow, bringing benefits to more and more people. They are a potentially powerful complement to philanthropy, which has underpinned much recent progress in public health.

My company, for example, is launching a portfolio of 15 essential medicines to treat diseases including diabetes, respiratory illnesses, and breast cancer. The aim is to make these medicines available to people of modest means in developing countries at a cost to local health systems of $1 per treatment per month. We will start in Kenya, Vietnam, and Ethiopia. It is a small first step, and we will learn as we go, with a goal of expanding to 30 countries in a few years.

To overcome the many hurdles to success in low- and middle-income countries, these new types of business ventures will likely need to explore innovative forms of collaboration with governments, non-governmental organizations, and other companies. Such collaboration has already shown that working across traditional boundaries, making creative use of technology, and developing pragmatic solutions can yield impressive results.

Bringing health care to everyone on the planet is a great challenge. It will take imagination, cooperation, and hard work. Greater involvement by business could increase the likelihood of getting there by 2030.

This article is published in collaboration with Project Syndicate. Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Jörg Reinhardt is Chairman of the Novartis Board of Directors.

Image: A health worker draws a dosage of vaccine into a syringe during a house call in the village of Kandor. REUTERS/Simon Akam.

Posted by Jörg Reinhardt -

All opinions expressed are those of the author. The World Economic Forum Blog is an independent and neutral platform dedicated to generating debate around the key topics that shape global, regional and industry agendas.

訂閱:

文章 (Atom)