Here’s how rising global interest rates could impact your life

- Countries including the United Kingdom, South Korea, New Zealand and Brazil all raised interest rates in 2021.

- The United States, European Central Bank and Japan are among those scaling down their emergency pandemic support for the economy.

- Borrowers and savers will be affected in different ways if the rates on products like mortgages and car loans change.

Interest rates are rising globally – and it means changes to the way we spend and save money.

The Bank of England – the United Kingdom’s central bank – raised interest rates for the first time in more than three years in December 2021, from 0.1% to 0.25%.

South Korea, New Zealand, Brazil, Russia and South Africa are some of the other countries that raised interest rates in 2021.

America’s central bank, the Federal Reserve System, expects to raise interest rates three times in 2022. It is also speeding up the wind-down of economic support introduced during the pandemic.

The European Central Bank, which sets interest rates for the 19 European countries using the euro currency, and Japan’s central bank, the Bank of Japan, are also scaling down economic support – though they have stopped short of an interest rate cut so far.

What are interest rates?

Interest is the cost of borrowing money, usually given as an annual interest rate. It is one of the main tools central banks can use to try and slow rising prices – inflation. Soaring demand coupled with supply shortages as the global economy bounces back from the pandemic are sending inflation to new highs. So central bankers – who manage each country’s currency and monetary policy – are taking action.

Here are some of the main ways our finances are affected.

Interest rates and home loans

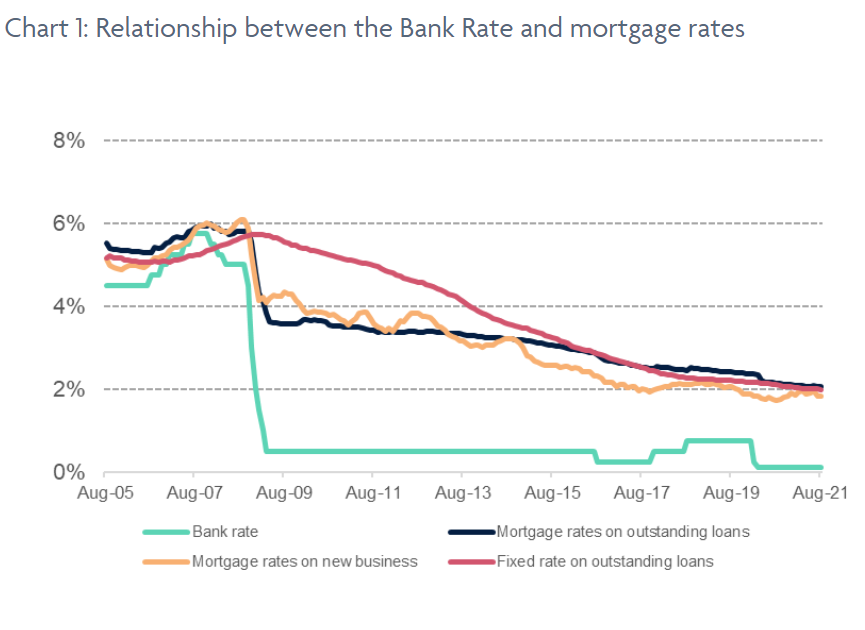

If you took out a mortgage to buy your home in the UK, the cost of your monthly repayment may rise. The amount will depend on the size of your loan. For example, based on an average mortgage of £140,000, banking trade association UK Finance estimates an average rise of £15 a month from the latest Bank of England interest rate rise. This is for the 850,000 mortgage borrowers with a tracker mortgage – a type of variable rate mortgage.

But you may see no change if your home loan is on a fixed rate – as 74% of home loans in the UK are, according to UK Finance.

“A sizeable majority of borrowers will see no immediate increase in their monthly repayments,” it says.

Interest rates and credit cards and other loans

If you have other borrowing, like credit cards, personal loans or car loans, the interest rate on these may rise, too. Policymakers worldwide are already worried about rising household debt globally, and the ability of consumers to pay back their debts.

For example, household debt in the US now tops $15 trillion, with auto loans, student loans and credit card spending up by $28 billion, $14 billion and $17 billion respectively in the third quarter of 2021, according to the Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York, one of 12 Federal Reserve Banks in the US.

By raising interest rates, central bankers hope to dampen runaway consumer spending and slow rising inflation.

Interest rates and savings

Higher interest rates, in theory, mean people receive a better return on their savings, which should encourage them to save rather than spend.

In New Zealand, for example, state-owned bank Kiwibank announced in October that savers would benefit from higher returns on a range of savings and term deposit rates – where money is locked away for an agreed length of time. This followed the first rate rise in New Zealand for seven years in October.

But sometimes higher savings rates can be slow to appear – if at all. Commenting on changes to savings accounts following the Bank of England’s rate rise in the UK, Anna Bowes of Savings Champion, which offers free savings advice, says: “Very little has happened so far”.

沒有留言:

張貼留言