https://www.weforum.org/agenda/2020/03/coronavirus-china-opportunities-change/

Coronavirus(武漢肺炎) in China – insights on the impacts and opportunities for change

The crisis has created some opportunities for positive change in China.

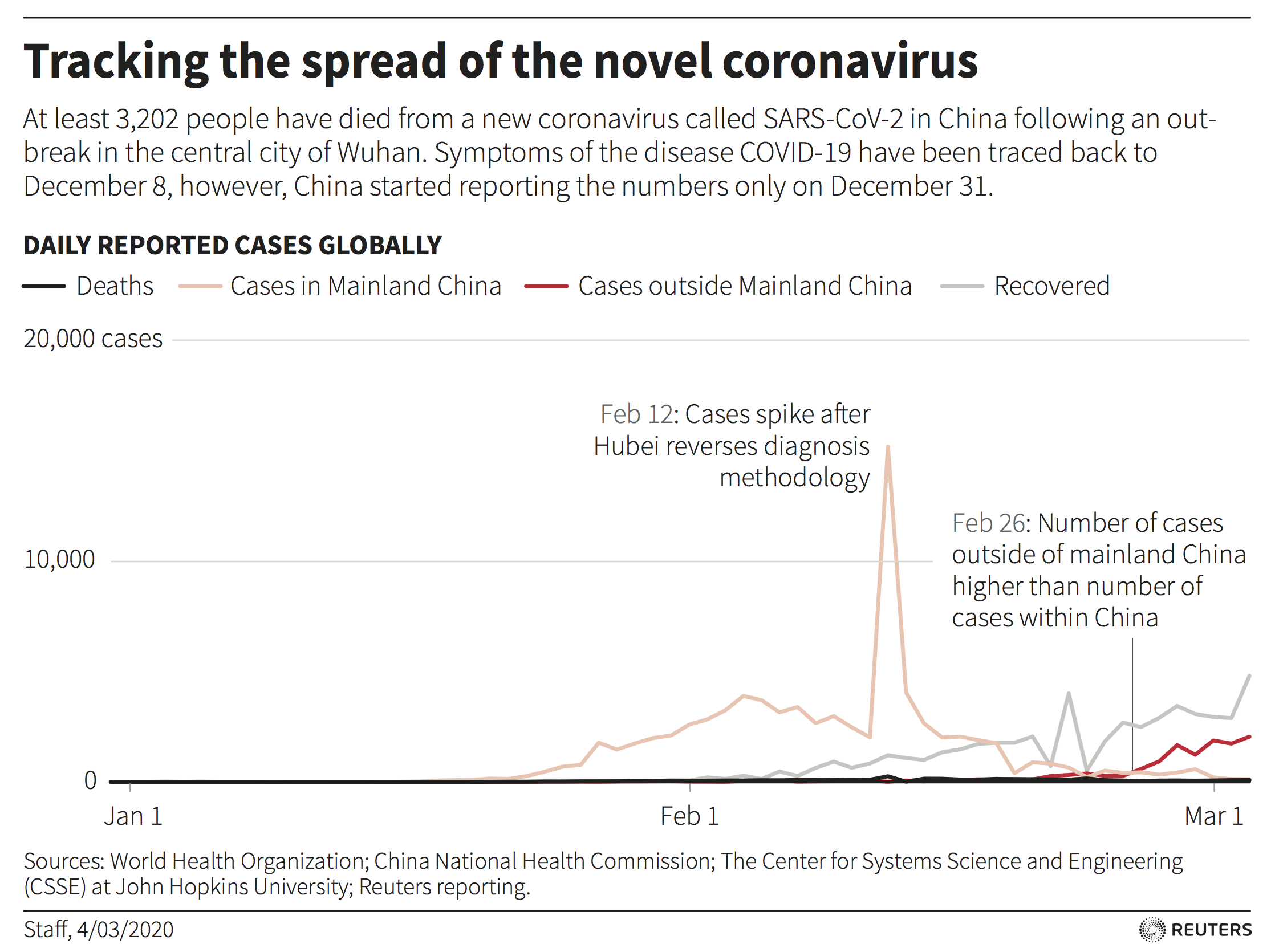

Image: REUTERS/Stringer

04 Mar 2020

- The crisis has built the basis for more professional and transparent public-private partnerships in China.

- Investors could seize opportunities in the long-term trend of technological innovation and capital market reform.

- The entrepreneurial spirit is now vital to Chinese businesses.

The recent outbreak of COVID-19 in China has led to significant impacts on businesses and industries. Through a webinar hosted by the World Economic Forum Beijing Office, here are the insights from top-level Global Future Council members, business and media leaders on how China is reacting to mitigate the impacts, adapt to the changes, and preparing for the bounce back in new opportunities.

Have you read?

China’s government becomes more transparent

Social media, such as WeChat and Weibo, has played an important role in reflecting public opinion during the outbreak, prompting the Chinese government to respond and adjust policies accordingly.

Public-private partnership has been strengthened in this outbreak – the Chinese government is expected to be more open for collaboration, while business has developed capabilities and a willingness to contribute more to public goods. This builds the base of a more professional and transparent collaboration for public agendas.

Financial market policies and outlook

Zhu Ning, Deputy Dean of Shanghai Advanced Institute of Finance, noted that the scale and global impact of the outbreak have exceeded that of SARS in 2003. As China tries to balance imperatives between disease control, economic recovery and population movement, annual GDP growth is expected to slow down to between 5 and 5.5% for 2020.

2020 is the final year of China’s 13th Five Year Plan period and holds certain economic growth targets to meet. It remains to be seen whether major policy adjustments will be made by the government.

Meanwhile, measures have been taken on key aspects of economic policy. For monetary policy, the central bank has relaxed the reserve requirement ratio and the loan prime rate. However, a new cycle of global interest rate cuts initiated by the US Federal Reserve to address the stock market fall, are yet to be announced. On fiscal policy, there are tax and rent reductions, deferred payments of social security and target funding. On a regional level, local governments have introduced policies for returning to work and production.

Though widely expected, it is unlikely that there will be another stimulus plan similar to the “2008 RMB 4 trillion”, considering the present economic scale of China. The price of bulk commodities, such as gold, has increased. But with limited choices of infrastructure projects and the restrained policy on house prices, a great surge is unlikely. Considering that China now verges towards a top margin of inflation, the intensity of new monetary policies and its impact on commodity prices need further observation.

Investment sentiment is running high. The stock market surged due to expectations of stimulus policies and limited choices of investment. The number of investors in China’s A-Share market increased over 10 million in recent months. As the global market starts to respond to the outbreak, the fervent scene of the domestic market needs more caution.

On this point, Tang Ning, Founder and CEO of CreditEase, proposed that with the service of professional institutions, investors in the capital markets could seize opportunities in the long-term trend of technological innovation and capital market reform to enjoy the dividend of capital market development.

Changes and opportunities for industries

Edward Tse, Founder of the Gao Feng Advisory Company, observed that a safe and healthy living environment is now considered equally, if not more important than economic growth. Earlier detection and prevention will be crucial for a future public health and management system. The system in China has proven its capability during the outbreak, in which the private sector has made a significant contribution. It has demonstrated the necessity and potential of public-private partnership.

The outbreak has accelerated the application of new technologies. Social communication was greatly diversified, making room for efficient and online measures of interaction. This trying time is also shaping the entrepreneurship of the private sector. Many businesses were driven not only by profits but also a desire to provide a social good.

Such changes imply multiple opportunities for industries, described below:

- New business models are emerging, especially in sectors such as health, logistics, automation, online office, entertainment, retail, and education;

- New generation smart cities are key to the future public agenda. Besides certain urban functions, a new generation smart city will systematically enhance public management by integrating supply chains, traffic, emergency and disaster warning.

- Big data will be more widely used for public wellbeing, especially for tracking, analysing, and supporting timely public decision-making.

- Offline-driven businesses begin to shift online, especially in education, entertainment, and retail.

- The value chain of healthcare will be extended to cover early detection and prevention. Future application scenarios will include more participants and promote a comprehensive ecosystem for public health agendas.

- Social media is changing from being the channel between not only individuals and business, but also public and the government.

Strategies for business

Adversity is a state of mind. Tang Ning, stressed that the entrepreneurial spirit – which features the faith and capability to turn crisis into opportunities – is now vital to Chinese businesses. The business models are already shifting. Remote work and online business, which faced obstacles previously, are now a necessity. Business must embrace the following strategies in order to seek and seize opportunities:

- Digitalization is the future. The outbreak is an opportunity to reshape and implement digital strategies. It in turn will create new opportunities. Capability building and new value creation are key for such transformations.

- Risk management needs to be re-evaluated. More attention will be directed to insurance, multiple sources of income and customers, and integration of online and offline business. To many Chinese businesses, especially small and medium-sized enterprises (SMEs), separation of family and business, diversified asset allocation and insurance are fundamental to risk management.

- SMEs need to take initiatives actively. Beside cost control, unique competitive edges have to be developed to the fullest. A great bounce back is expected across industries after the outbreak, and SMEs need to reflect on how to relate to and seize the next wave of growth.

Technologies for the public good

According to Wu Tian, Baidu Corporate VP, big data is leveraged to help analyze the outbreak development and support disease prevention and control. Online data platforms can be used to predict the future by combining local infections and population moves, and therefore optimize allocation of public resources. Big data can also provide insights in terms of identifying high-risk areas in a timely manner. The public can check the epidemic area on Baidu Map APP.

AI technologies are integrated with infrared imaging for rapid and multiple body temperature monitoring. This tech can quickly screen crowds to improve detection efficiency and reached an accuracy rate over 90%, which also prevents virus transmission.

Share

License and Republishing

World Economic Forum articles may be republished in accordance with our Terms of Use.

沒有留言:

張貼留言